How to Create a Budget for Your Gynecology Practice

- November 21, 2023

- 2 minutes

Operating a gynecology practice requires a deep understanding of the medical field, but also a deft handle on the business aspects of the operation. One of the most crucial components of running a successful practice is maintaining a well-structured budget. This article outlines the steps needed to create an effective budget for a gynecology practice.

-

Understand Your Revenue Streams:

The initial stage in budgeting involves identifying your revenue streams. In medical practice, revenue primarily comes from patient services, including consultations, treatments, and procedures. These can be further subdivided based on insurance and private pay patients. It's essential to track these revenue streams accurately, as they form the foundation of your practice’s financial stability.

-

Examine Your Fixed and Variable Costs:

Once you've determined your revenue streams, it's time to analyze your costs. These can be divided into fixed costs, such as rent and salaries, and variable costs like medical supplies and utilities. Understanding the ratio of fixed to variable costs is crucial, as it can help you predict fluctuations in your budget based on patient volume.

-

Allocate Funds for Future Investments:

As a gynecology practice, staying up-to-date with the latest medical technologies and procedures is of utmost importance. Therefore, it's prudent to allocate a portion of your budget for investments in equipment upgrades, staff training, and other advancements.

-

Consider Contingency Planning:

Unforeseen situations like lawsuits or market downturns can drastically impact your budget. Having a contingency plan in place allows for financial resilience. This might involve setting aside a portion of your revenue for an emergency fund or securing robust insurance coverage.

-

Forecasting:

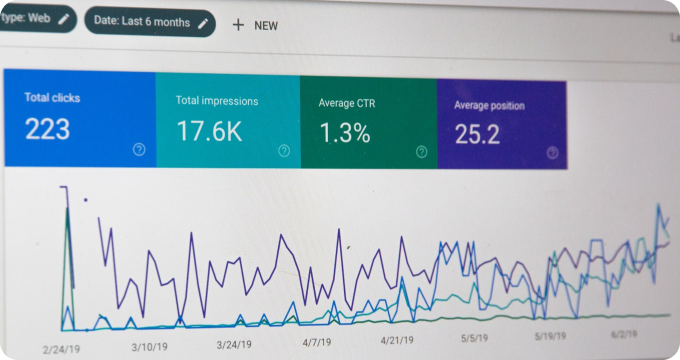

Utilizing past financial data, you can forecast future financial performance. This involves extrapolating trends in revenue growth, cost increases, and other financial indicators to predict your practice's financial health. However, forecasting is not an exact science, and results should be interpreted with caution.

-

Monitor and Adjust:

Even the most meticulously planned budgets require regular review and adjustment. Regular monitoring allows you to spot any discrepancies, assess the effectiveness of financial strategies, and make necessary changes promptly.

Now, let's delve into the economic concept of opportunity cost, which is the potential benefit an individual, investor or business misses out on when choosing one alternative over another. In the context of a gynecology practice, opportunity costs might include foregoing a piece of advanced equipment to invest in staff training instead. Understanding this principle can help in making informed decisions about resource allocation.

Next, let's consider the Pareto Principle, often referred to as the 80/20 rule. It states that 80% of the effects come from 20% of the causes. In your practice, this could mean that a small proportion of your patients might be contributing a significant chunk of your revenue or that a few key expenses could be driving the majority of your costs. Recognizing these patterns can help streamline your financial operations and increase efficiency.

In conclusion, creating a budget for a gynecology practice is a multifaceted task that requires an understanding of various financial principles and healthcare-specific considerations. Whether you are launching a new practice or looking to improve an existing one, a well-crafted budget is an invaluable tool that can guide your financial strategies and facilitate sustainable growth.

Learn More

Unleash the power of knowledge and take control of your health by diving deeper into our enlightening blog posts about gynecologists. For those seeking top-notch care, they are encouraged to explore our comprehensive rankings of the Best Gynecologists in New Orleans.

Popular Posts

-

7 Reasons Why You Need a Regular Visit to Your Gynecologist

7 Reasons Why You Need a Regular Visit to Your Gynecologist

-

Unveiling the Truth: 10 Common Myths about Gynecology Debunked

Unveiling the Truth: 10 Common Myths about Gynecology Debunked

-

4 Things I Wish I'd Known About Gynecologists Before My First Appointment

4 Things I Wish I'd Known About Gynecologists Before My First Appointment

-

What are Gynecologists (and how do they work in Women's Health Care)?

What are Gynecologists (and how do they work in Women's Health Care)?

-

Ask These Questions to a Gynecologist to Choose the Right One for You

Ask These Questions to a Gynecologist to Choose the Right One for You